child tax credit december 2021 how much

Child Tax Credit 2021 vs 2022. In 2020 the refundable part of the credit was 1400 at most.

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

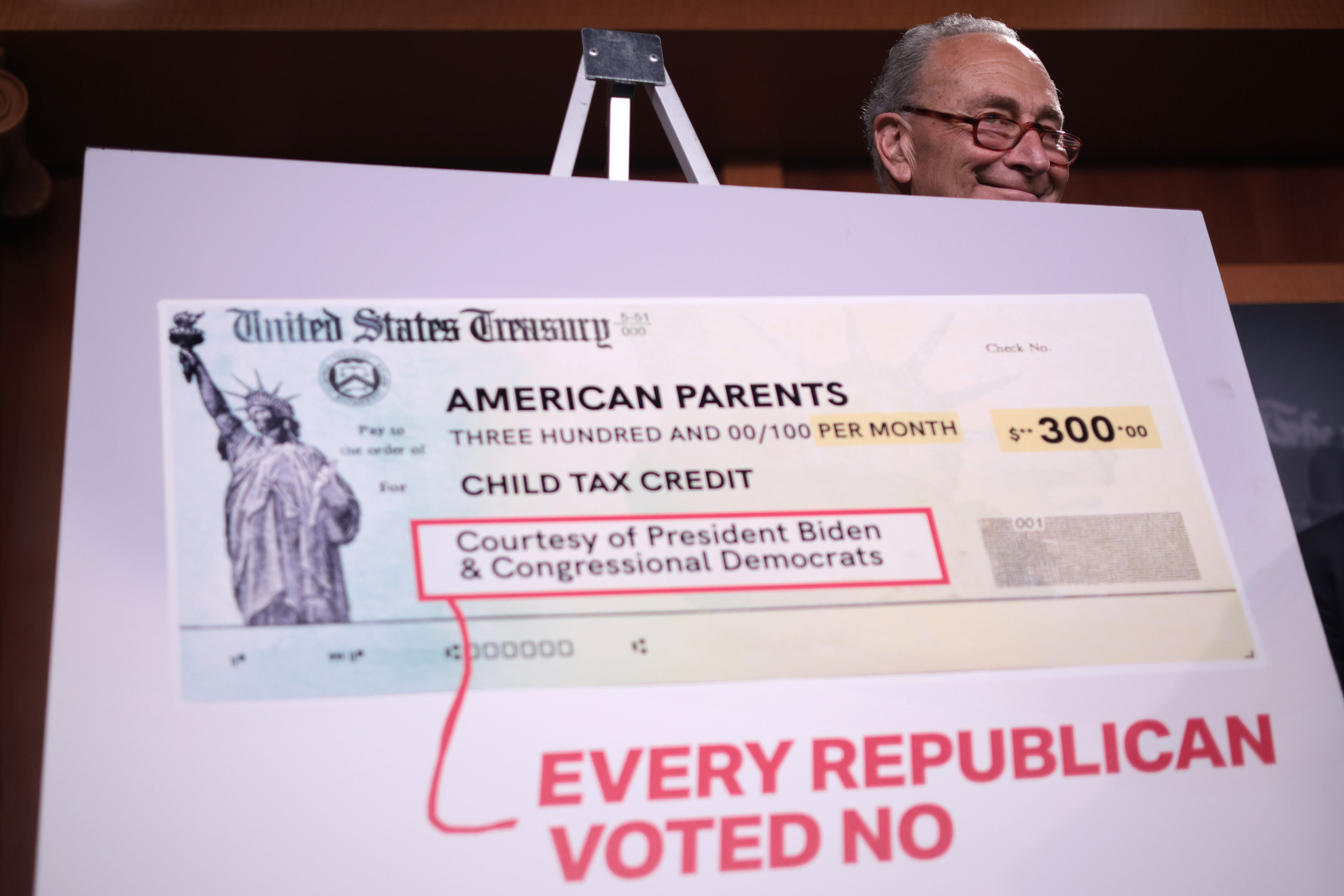

Under the enhanced CTC families with children under 6 received a 3600 tax credit in 2021 with 1800 of that sent via the monthly checks or 300 per month.

. The earned income tax credit also known as the EITC or EIC is a refundable tax credit for low- and moderate-income workers. The 2021 credit increased to 3600 from 2000 in 2021 and you receive a credit for each child under six years of age. Qualifying children can include a birth child stepchild adopted child or foster child placed by a court.

See what makes us different. To be a qualifying child for the 2021 tax year your dependent generally must. Additionally the trillion-dollar stimulus bill.

The 500 nonrefundable Credit for Other Dependents amount has not changed. From July to December of 2021 eligible families received an advance child tax credit up to 300 per child under six years old and 250 for children between the ages of six to 17. You would be eligible to receive 1800 in 2021 and 1800 when you file your tax return.

3000 for children ages 6 through 17 at the end of 2021. First your child cant be older than 18 by the end of December 2021. The credit amount increases up to 3600 for eligible families with children age 0 through 5.

Be under age 18 at the end of the year Be your son daughter stepchild eligible foster child brother sister stepbrother stepsister half-brother half-sister or a descendant of one of these for example a grandchild niece or nephew. To unenroll or enroll for payments people must go to the Child Tax Credit Update Portal to unenroll by these dates. Ad File a free federal return now to claim your child tax credit.

How much is child Tax Credit in December 2021. If you took advantage of the advance child tax credit payments in 2021 your family was allowed to receive 50 of your estimated credit from July through December. The changes increased the child tax credit from 2000 to 3000 for children over 6 and to 3600 for children under 6.

In 2022 the range is 560 to 6935. We dont make judgments or prescribe specific policies. The new advance Child Tax Credit is based on your previously filed tax return.

For the 2021 tax year the earned income credit ranges from 1502 to 6728 depending on tax-filing status income and number of children. The 2021 Child Tax Credit will be available to nearly all working families with an income of under 150000 for couples or 112500 for a single-parent household. 3600 for children ages 5 and under at the end of 2021.

To be eligible for the maximum credit taxpayers had to have an AGI of. Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics. The two most significant changes impact the credit amount and how parents receive the credit.

The Child Tax Credit was increased in 2021 to 3000 for children over the age of six and 3600 for children under the age of six up to 17 years old. Lets say you qualified for the full 3600 child tax credit in 2021. The current credit is worth 3600 for each child under six and 3000 for those between six and seventeen.

First the credit amount was temporarily increased from 2000 per child to 3000 per child 3600. 75000 or less for singles 112500 or less for heads of household. The remaining 1800 will be claimed.

For 2021 only the child tax credit amount was increased from 2000 for each child age 16 or younger to 3600 per child for kids who are 5 years old or younger and 3000 per child for kids 6 to. The full amount of this credit is refundable for the first time ever. The Child Tax Credit under the American Rescue Plan rose from 2000 to 3000 for every qualified child over the age of six and from 2000 to 3600 for each qualifying child under the age of six beginning in tax year 2021 the taxes you file in 2022.

Parents must fall under certain income thresholds in order to receive the full credit 150000 if married and filing jointly 112500 for heads of household and 75000 for. How Much is the Child Tax Credit for 2021 2022. For 2021 only the child tax credit amount is increased from 2000 for each child age 16 or younger to 3600 per child for kids who are 5 years old or younger and 3000 per child for kids 6 to 17 years of age.

For tax year 2021 the Child Tax Credit increased from 2000 per qualifying child to. The 2021 child tax credit is worth up to 3000 for eligible families with children age 6 through 17. The child tax credit has also been increased for the 2021 tax year to 3600 per child ages 5 and under and 3000 per child ages 6 through 17 up from 2000 per child.

By August 2 for the August.

Banking Financial Awareness 19th December 2019

Parents Guide To The Child Tax Credit Nextadvisor With Time

Child Tax Credit 2021 8 Things You Need To Know District Capital

Child Tax Credit Ending Will Push 10 Million Kids Back Into Poverty

Romney Child Tax Credit Proposal Is Step Forward But Falls Short Targets Low Income Families To Pay For It Center On Budget And Policy Priorities

Fy 2020 21 Ay 2021 22 Itr Forms For Salaried Individuals Other Income Sources Which Itr Form To Download File Itr Online Tax Filing System Filing Taxes Indirect Tax

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

Public Notice Update Banking Information To Get Reverse Tax Credit Barbados Today Tax Credits Motivational Skills Banking

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

Banking Awareness Of 10 11 And 12 December 2021

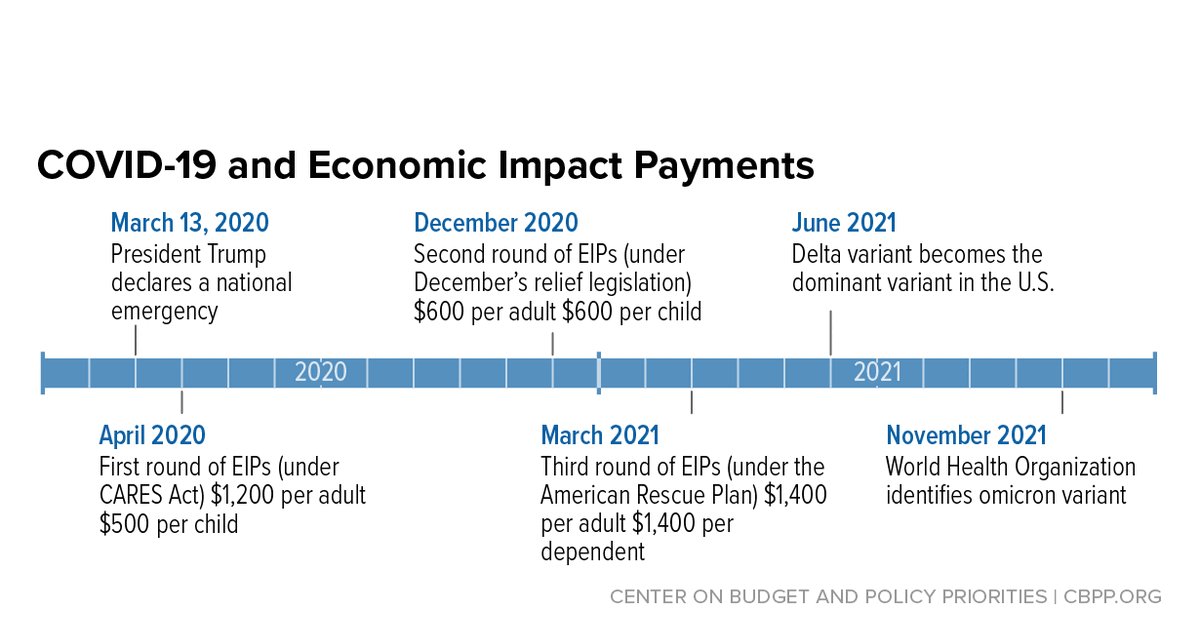

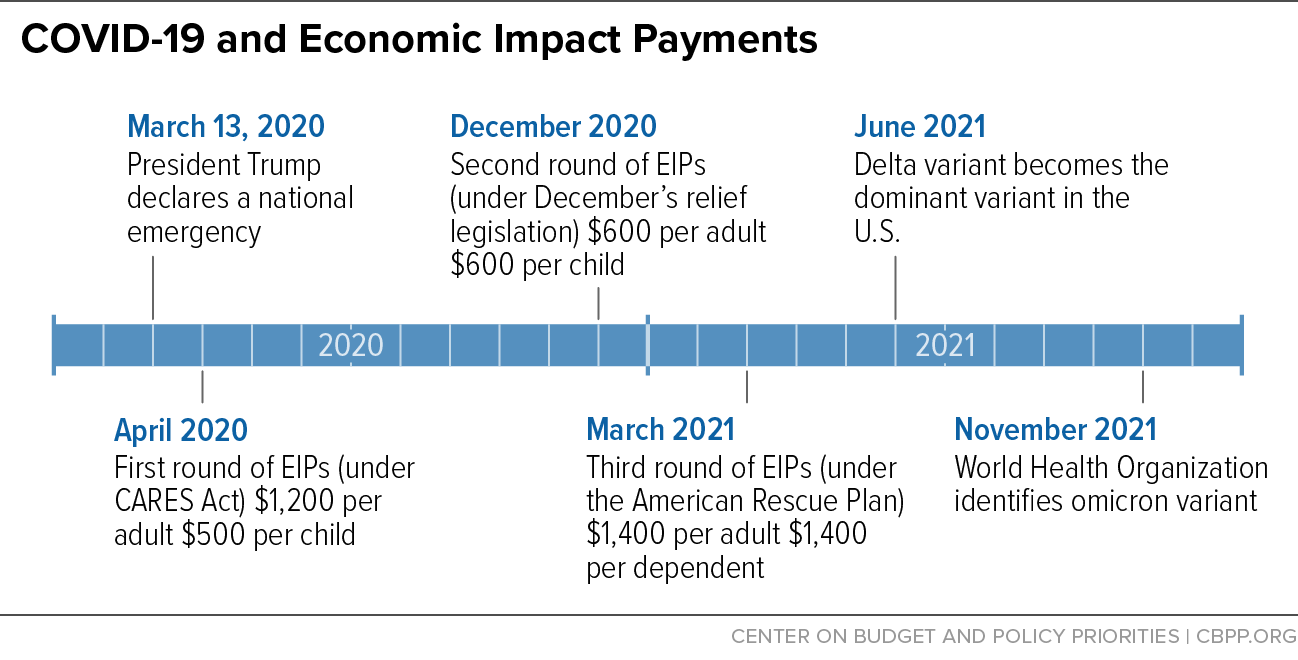

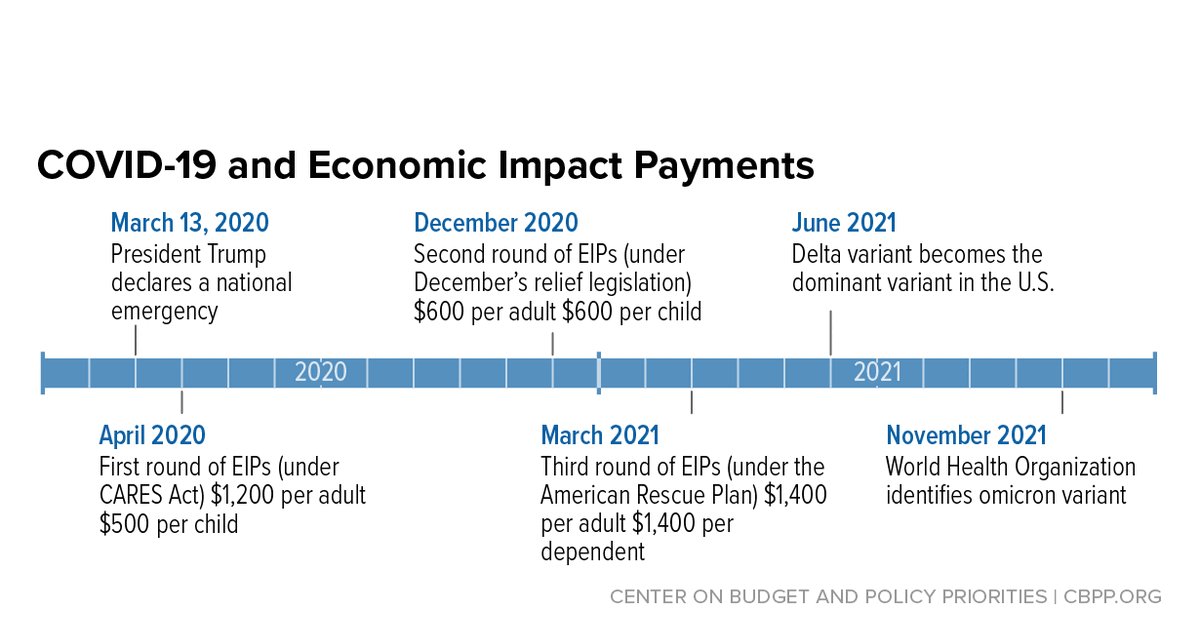

Stimulus Payments Child Tax Credit Expansion Were Critical Parts Of Successful Covid 19 Policy Response Center On Budget And Policy Priorities

December S Payment Could Be The Final Child Tax Credit Check What To Know Cnet

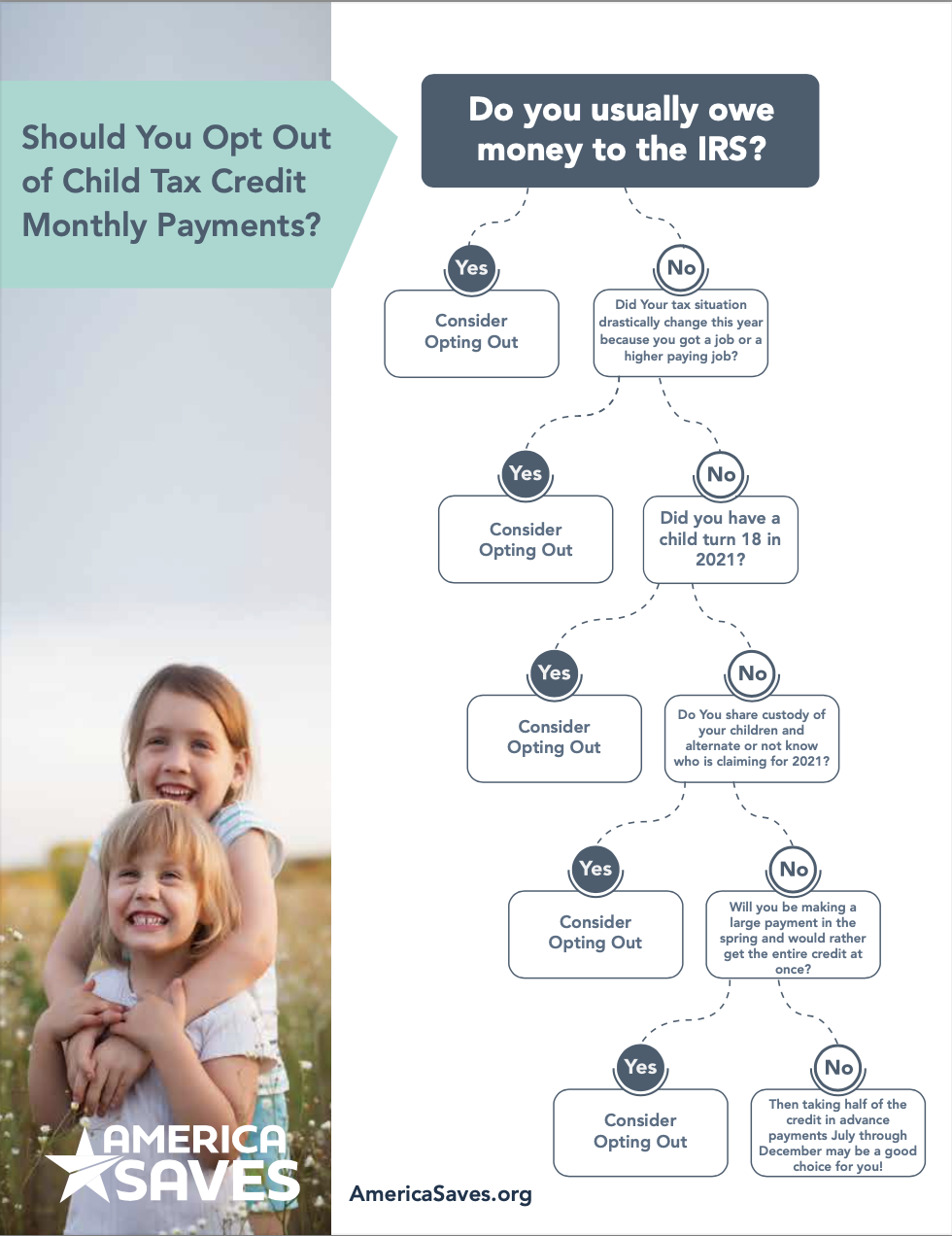

What You Need To Know About The 2021 Child Tax Credit Changes America Saves

Stimulus Payments Child Tax Credit Expansion Were Critical Parts Of Successful Covid 19 Policy Response Center On Budget And Policy Priorities

2021 Child Tax Credit Advanced Payment Option Tas

Help Is Here The Expanded Child Tax Credit Congressman Emanuel Cleaver

December Child Tax Credit Date Here S When To Expect 1 800 Stimulus Check

Internal Audit Now Required For Itc Credit Penalties And More Internal Audit Data Analytics Tax Credits